Viking Holdings - Pre-IPO Analysis

Viking Holdings has filed to go public and we thought it would be interesting to compare and contrast Viking to the other cruise companies. Below are some of our early thoughts on the company and how it compares to the ones we know better – Royal Caribbean and Norwegian Cruise Lines. We do not have a lot of history studying river cruises, so our thoughts are preliminary, and this will not involve commentary on Viking’s valuation or its attractiveness as an investment.

High Level Observations

Viking is best known for its river cruising business – especially in Europe. It has 81 river vessels, including 58 Longships, operating on 21 rivers in different regions of the world. It also has 9 ocean cruise ships and 2 expedition ships. It carried around 650,000 passengers last year and will grow capacity aggressively through the end of the decade according to the pipeline below:

Source: Viking Holdings F-1

If it exercises all its options, its river capacity would increase by about 30% and its ocean capacity would increase by nearly 120% through 2030. In total, its capacity would increase by over 60%.

The entire company operates under the Viking brand, which is quite different from the other public holding companies which operate a number of brands. We can see a few obvious differences so far:

One brand operating in different frontiers – river, ocean, expedition. The brand aims at the upscale market on smaller ships in all frontiers.

In each frontier, Viking operates identical ships. There is no “newness” or innovation that has been popularized by the likes of RCL, NCLH, and CCL. This has positives, such as (a) a consistent experience for all guests with easier lifetime yield management, (b) a simplified selling process on itineraries only, (c) more efficient crew training and ship maintenance, and (d) operating flexibility when changes must be made.

Consistent with the cruise industry, Viking claims very high NPS scores and has earned very positive rankings from third parties. It enjoys high repeat rates, strong early booking patterns, and cheap access to capital, similar to other cruise lines. It generates industry-leading returns on invested capital of 27.5% in 2023. I did find it a bit odd that the company seemed very keen on attacking the public ocean cruise companies in their roadshow presentation even though they have limited competitive overlap.

Since I’ve never taken a Viking river cruise, it’s hard to compare the two experiences as a consumer. I’d imagine the smaller, more intimate ships would allow for guests to build more meaningful relationships with each other during their travels. Arriving in city centers expands opportunities for passengers to hit the ground running efficiently for their daily activities, and river cruising in general offers a pleasant way to travel through regions. On the downside, I believe it could get a little boring or repetitive eating at the same restaurants and visiting the same 2-3 venues for 1-2 weeks in a row.

River vs. Ocean Cruising

One of my biggest questions coming into the Viking pre-IPO analysis was how river cruising economics compare to ocean cruising. In this section we try to tackle this analysis by looking at Viking Longships, the company’s most widely used vessel.

Viking’s Longships typically carry 190 passengers and have been running in the mid-90s in occupancy. They cater to the affluent 55+ demographic and do not allow children under 18 years of age onboard. Viking’s cruises are almost all-inclusive (beer and wine included at meals, but not in the lounge) and, with identical hardware, the company focuses customer attention and appeal on its itinerary destinations. Each destination has one free shore excursion option, but optional paid excursions are also available. Viking hopes to attract customers it calls Thinking Persons and it tailors its vacations to curious travelers interested in understated luxury experiences.

In contrast, modern ocean cruise ships offer a mix of destination appeal and ship appeal, with some customers drawn to the ship as the destination, and others drawn to its itineraries. Most customers want a mix of both, but the post-Covid cruise market has seen elevated demand for short beachy cruise itineraries on amenity-rich megaships to the Caribbean in drive-accessible markets. Additionally, families are welcome and large ships often serve as great options for multi-generational vacations.

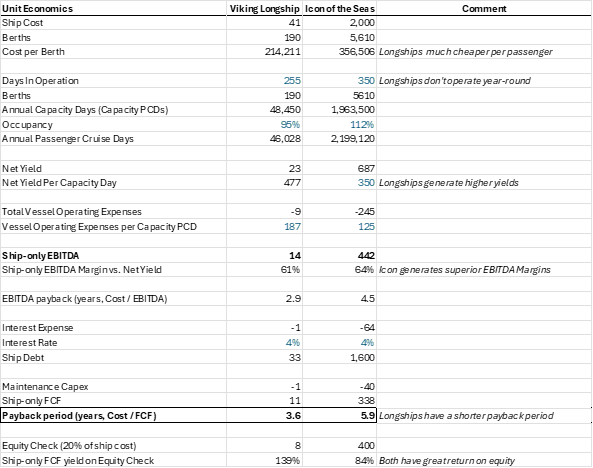

Below we compare Viking’s river identical longships to Royal Caribbean’s Icon of the Seas. Let’s look at them side-by-side by going through estimated unit economics for each:

Source: Company Filings, Recurve Capital Estimates

Let’s highlight some key differences above:

Viking’s ships are significantly smaller and less expensive per berth. However, what the cost per berth metric doesn’t capture are the amenities per passenger available on each ship. Longships offer 2 restaurants (both with the same menu) and one lounge. Icon of the Seas has 40 bars and restaurants, many significant entertainment venues, a casino, a water park, and more.

Viking’s longships don’t run year-round – they tend to operate 8-9 months out of the year.

Contemporary ocean cruise ships like Icon of the Seas benefit from >100% occupancy levels because allow children onboard. Viking doesn’t allow children and thus operates below 100% occupancy levels.

Longships generate higher net yields due to their premium targeting and higher per diem prices, but they generate less onboard revenue per passenger compared to Icon.

On our estimates, Longships have a payback period of about 4 years, while Icon has a payback closer to 6 years on a ship-only free cash flow basis. These payback periods differ from what the companies have said (4-5 years for Longships, 4 years for Icon). Both enjoy excellent returns on the 20% equity check required for their export credit agency financing.

Longships appear to be more financially efficient than Icon of the Seas (no surprise given the higher ROICs), but these are ship-only economics that do not contemplate the incremental SG&A required to fill and operate them.

The launch of Icon generated significant buzz and tens of millions of free ad impressions from that buzz. The launch of a new Viking longship, identical to others in the fleet, is relatively unremarkable unless it opens up a new market (like the Mississippi River in 2022). The global supply chain and operational infrastructure needed to fill and operate a ship like Icon of the Seas are on a completely different scale than operating a river cruise ship, which runs more like a local moving hotel. RCL’s operating platform is highly scalable and, we believe, ultimately will generate more interesting returns on incremental invested capital when compared to Viking’s Longships. However, both companies can fuel nice earnings growth over time.

Based on our initial review, we have a preference for owning moving resorts (like Icon) over moving hotels because the mix of destinations and onboard amenities and venues appeals to a wider audience and likely captures a higher proportion of guests’ vacation wallet share. On that front, it’s worth mentioning that our brief analysis of Viking’s Ocean unit economics results in yields and paybacks similar to other ocean cruise companies, particularly ones that appeal to the luxury market.

Lastly, we have touched on the value of having private destinations in our prior Insight. The three large ocean cruise companies have a range of private destinations, but Viking doesn’t (yet) have any. Done well, private destinations inflate the yields of all visiting ships and nicely enhance returns.

Conclusion

This was meant to be a brief study of Viking’s river cruise business, especially in relation to the large ocean cruise companies. Viking boasts higher returns on invested capital and an aggressive growth plan driven by a large future order book. It should enjoy above-average growth through the end of the decade and there is a lot to like about its ability to stamp out additional capacity over time. However, one thing to consider is that the company’s mix of business will be shifting more toward ocean cruises over the coming years and its financial efficiency ratios likely will be pressured (due to their longer paybacks vs. river cruising), despite driving accelerating growth. Are Viking’s big bets on ocean cruising an admission by the company that the river cruising is more mature?

Thankfully, even though the brands compete in the vacation market, this is not a zero-sum opportunity for cruise operators: all of them are taking share in the vacation market against more expensive land-based alternatives and they can address a large population of travelers that want to vacation around the world.