Perfect Day at CocoCay, Royal Caribbean’s Private Island

In 2019, Royal Caribbean Cruises (NYSE: RCL) introduced a $250m private island transformation called Perfect Day at CocoCay. All the major cruise operators own and operate private islands in the Caribbean, but RCL’s is the most impressive among them. According to the company, customer feedback around the on-shore experiences in the Caribbean was below RCL’s expectations for delivering consistently outstanding vacations. The company hypothesized that it could bring unique and highly satisfying experiences to customers through its private island transformation project. It has been overwhelmingly successful. This post will discuss the reasoning behind RCL’s significant investment into the private island and the benefits we believe it has generated for the company.

Background on Cruising

The Caribbean is the world’s largest cruise market. All the major cruise lines have headquarters in Florida and the region’s year-round nice weather and access to numerous international beachy destinations allow operators to deliver tropical vacations to customers while also abiding by the Jones Act, thereby relieving them of income tax obligations. The primary downside is hurricane season, but thankfully cruise ships move around to avoid major storms!

Cruise ships offer incredible value to consumers for those wanting a turn-key, all-inclusive vacation experience with destination variety. Simply walk onto a cruise ship and all your needs are cared for – food, beverage, destinations, spa treatments, entertainment, activities, and more are available to you, much of which can be booked before boarding. Cruise operators manage almost every operation onboard, allowing to improve service levels and monetize their captive customers across many different formats, depending on customers’ preferences.

In 2023, Royal Caribbean generated about $200 per passenger in ticket revenues and about another $100 per passenger in onboard & other revenues. Onboard spending is comprised of premium food & beverage (alcohol, premium restaurants, etc.), retail, excursions, casino, and other revenues. There has been a broader trend in the cruise industry to pre-book onboard activities well before customers board ships via the cruise operators’ first-party apps, giving operators flexibility to bundle, promote, and monetize customers effectively. In Q3 2023, RCL said that 70% of guests made pre-cruise purchases and those who purchased onboard experiences before their cruise spend 2.5x more than those who only bought once onboard.

While all the major cruise holding companies have private island destinations, Royal Caribbean’s Perfect Day at CocoCay is in a class of its own. Most others offer lounge chairs on the beach, a few simple food & beverage options, ocean activity rentals, and/or cabana rentals. RCL reportedly invested $250m to create Perfect Day at CocoCay, a major upgrade from the island RCL assumed ownership of upon acquiring Admiral Cruises in 1988.

RCL’s ships are the main drivers of revenue and profits for the company, but CocoCay is an interesting case study because of its highly accretive contributions to the largest cruise market in the world. Let’s dive in.

Perfect Day at CocoCay

RCL transformed Little Stirrup Cay, adjacent to NCLH’s Great Stirrup Cay, into Perfect Day at CocoCay in May of 2019. It is one of the Berry Islands in the Bahamas.

CocoCay is tiny – 1.57 km wide (east to west) by 0.43 km long (north to south). Nonetheless, this tiny destination is bursting with activities for up to 13,000 passengers per day.

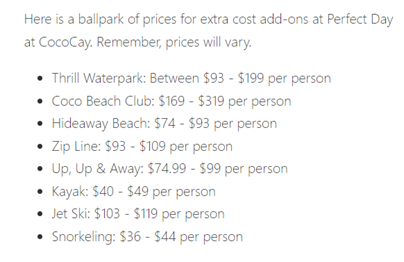

Most on-shore activities, all provided by RCL, cost extra. Below is a price list I found on the internet:

Additionally, the over-the-water cabanas seen in the picture above accommodate eight guests and can cost over $2,000 for the day.

It’s fair to say that while there are lots of free activities (basic food, pools, beach chairs), the excitement around going to CocoCay revolves around its unique activities and amenities – especially when considering how other days are spent on a Caribbean cruise.

Now, let’s assess RCL’s investment of $250m into this transformation. There are a few elements to consider:

RCL has said that itineraries touching Perfect Day at CocoCay generate ticket about 15% above comparable Caribbean cruises that do not go to CocoCay.

RCL has said that 2.5 million guests visited the island in 2023, and will increase to 3 million in 2024 with the addition of Hideaway Beach, a new, adults-only area.

Guests spend on average $100-150 per day while visiting the island. Based on the price list above, it’s not hard to get to those levels by doing 1-2 activities. It’s also worth considering that customers are paying more to go to CocoCay, so those that go are self-selecting and predisposed to the unique activities the island has to offer.

Now, some basic math to assess RCL’s return on investment:

2.5 million guests x $125 per guest = $312.5 million of incremental island revenue. Many of these activities are very high margin, and I assume ~70% margins = $220 million of incremental gross profit. Onboard revenues tend to carry ~80% margins, but I assumed slightly lower margins at CocoCay to be conservative given higher average labor costs.

2.5 million guests x 15% yield premium x $180 average yield per day excluding CocoCay x 6 day average cruise = $405 million of incremental ticket revenue. This $405 million comes at about 80% gross margins (~20% agent commissions), or $324 million of incremental gross profit.

Taken together, RCL reportedly invested $250 million into a private island revitalization project that generates roughly $545 million of incremental gross profit – less than a 6-month payback. With minimal overhead burden, much of this translates straight into earnings and is worth nearly $2/share of EPS. The 2024 addition of Hideaway Beach, an adults-only area, adds capacity for another 500,000 guests each year and will drive incremental gross profit and earnings on top of an already high-returning transformation project. Investments like these are excellent – they are high ROIC and add profits on top of already-strong 3- to 5-day cruises, and they have strong predictability because customers stay captive and book well in advance.

Additional Strategic Benefits

Beyond the direct and quantifiable financial benefits of CocoCay, there are other important characteristics worth discussing. Most importantly, with CocoCay, RCL has created a destination for children, families, and adults that can compete as an alternative to Hawaii, Mexico, Orlando and Las Vegas. This has increased RCL’s exposure to more new-to-cruise and new-to-brand customers. See below for their comments on these trends from their Q3 2023 earnings call:

“We have seen a significant increase in new to brand and new-to-cruise customers this year. In fact, in the third quarter, approximately 2/3 of our guests were new to cruise or new to brand, all while also doubling the repeat booking rate, indicating strong loyalty and satisfaction.”

This is a big deal and very positive for long-term demand trends. Cruise companies benefit from having a large base of loyal customers that love the vacationing format, but they also need to attract new-to-cruise customers to generate demand growth in excess of supply growth. Demand outgrowing supply has been consistent for the last few decades and has generated healthy pricing (“net yield”) growth over time. CocoCay has differentiated RCL from its cruising peers by allowing it compete more effectively for land-based vacationers. A family thinking about a long weekend trip to Cancun likely won’t book a 10-night cruise anywhere, but the kids could easily get very excited for a 3-5 night cruise that features CocoCay. While it may be a stretch to call it a Disneyland-like destination in the Caribbean, demand trends suggest it has nice gravity for families.

Additionally, investing in a land-based destination is accretive to all the ships that touch the island, improving yields for new ships and for older ships. The Freedom of the Seas, despite being a 20-year-old ship, is now one of the highest returning ships in the fleet because it benefits from visiting CocoCay.

Perfect Day at CocoCay is not the end of RCL’s ambitions in captive destinations. RCL is working on additional private destinations, including Perfect Day at Lelepa, a private island destination in Vanuatu in the South Pacific, and the Royal Beach Club at Paradise Island in Nassau, Bahamas. These are long-term projects that, when complete, will serve roughly 800,000 and 1 million annual guests, respectively.

55% of RCL’s Caribbean passengers will visit CocoCay in 2024, but longer term we expect all of RCL’s Caribbean guests, across major its brands, to visit one or more of the company’s unique and private destinations. The company has a tremendous opportunity to bring unique and exciting experiences and amenities to large-scale, captive customers with almost no uncertainty of guest volume.

Royal’s commitment to investing in exciting guest experiences create win/win/win situations for guests, RCL, and host countries creates, and it generates competitive differentiation, end market expansion, and long-term equity value accretion for shareholders. Its investments in these areas expands its addressable market to new classes of vacationers, which in turn further opens the customer funnel for its other cruise products. A 4-night Caribbean cruiser may turn into a 7-night Alaskan cruiser the next year, and then a 12-night Mediterranean cruiser the year after.

RCL has invested in and innovated around improving the “gateway” cruise and, in turn, has outperformed its cruising peers by a significant margin in the post-Covid recovery period. Its 2023 net yields are expected to increase roughly 13% vs. 2019 levels compared to NCLH at 4.5% and Carnival at 7.8%. Although cruise demand has been robust globally, much of its outperformance can be attributed to its superior execution in the Caribbean, where it has deployed a higher share of capacity while generating superior yields for all the reasons discussed above.

Closing

We believe the cruise sector is a secular winner in the vacation market for customers that want to see different parts of the world on a moving city filled with fun amenities. Hopefully this study of CocoCay highlights one way cruise companies can offer unique value-added experiences for guests that are both highly attractive to those guests and nicely accretive to operators like RCL. The economies of scale from bringing millions of guests to captive experiences offers cruise companies significant opportunities to delight customers while also improving margins and earnings for shareholders.